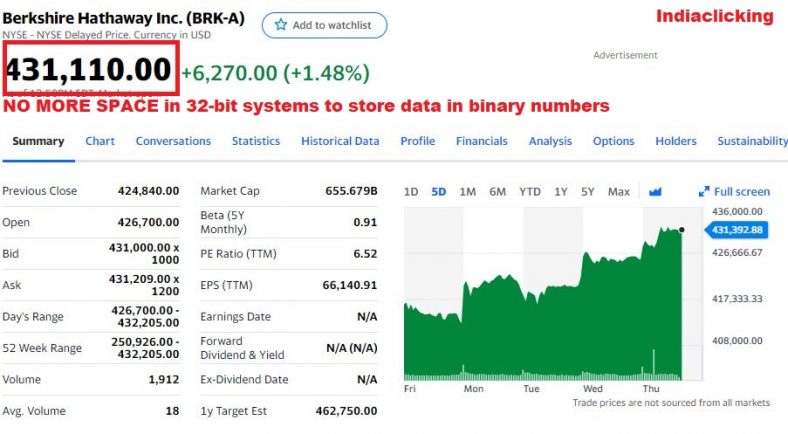

This is strange but true, if the US stock exchange Nasdaq doesn’t upgrade its computer systems soon, it may not be able to accommodate the Warren Buffett’s Berkshire Hathaway share price, which has risen to over $4,21,000 per Class A share. The reason being: Berkshire Hathaway’s share price is very close to the highest number that Nasdaq’s computers can handle.

Nasdaq and a few other market operators use 32-bit systems to store data in binary numbers, which comprises ones and zeroes. Therefore, the biggest possible number is two to the 32nd power minus one, which is 4,294,967,295. Stock prices are usually displayed up to four decimal places, so the highest possible price is $429,496.7295, the FE report said.

Nasdaq temporarily stopped displaying Berkshire Hathaway share price of Class A shares over various data feeds.

Also Read – What is short position in stock market ?

“Even other stock exchanges like IEX Group Inc., had said months earlier that it would stop taking orders in Class A shares due to an internal price limitation within the trading system,” according to a Wall Street Journal report. As Warren Buffett’s firm’s stock price is approaching close to this level, Nasdaq temporarily stopped displaying the prices. “No other stock is anywhere near Berkshire Class A’s stratospheric price levels, so it is understandable why the engineers behind Nasdaq’s and IEX’s systems chose the number format, which programmers call a four-byte unsigned integer,” the report added.

Leave a Comment