Steps by step process to check dividend received in the brokerage account of Zerodha, Groww, Angel Broking, 5Paisa, ICICI Direct, Upstocks etc or bank account or Demat account. You can also track to check the dividend received in the Bank account of the primary holder of the stocks.

In general the companies declare the dividend pay-out to the shareholders in their quarterly results. A company pays a dividend to make stocks attractive for the investors and to retain them for long run.

Key Highlights :

Important to remember while Dividend Pay-out

1. Declaration Date: The date of declaring the dividend. It includes dividend amount, ex-dividend date and payment date.

2. Record Date: It is the date by which the company must record an investor. Only such shareholders who will hold the shares as on date are entitled to get the dividend payment. To be eligible to be added in the company’s book, it is essential to buy stocks at least two days before the record date.

3. Ex-Date: This is usually before the record date. If you purchase shares on or after the ex-date, you are not eligible to get the dividends. The stock exchanges determine the ex-date.

4. Payment Date: The day of making the Dividend payment to the account of the shareholders. This is usually a month from the record date. The declared stock dividends are paid out on the Payment Date.

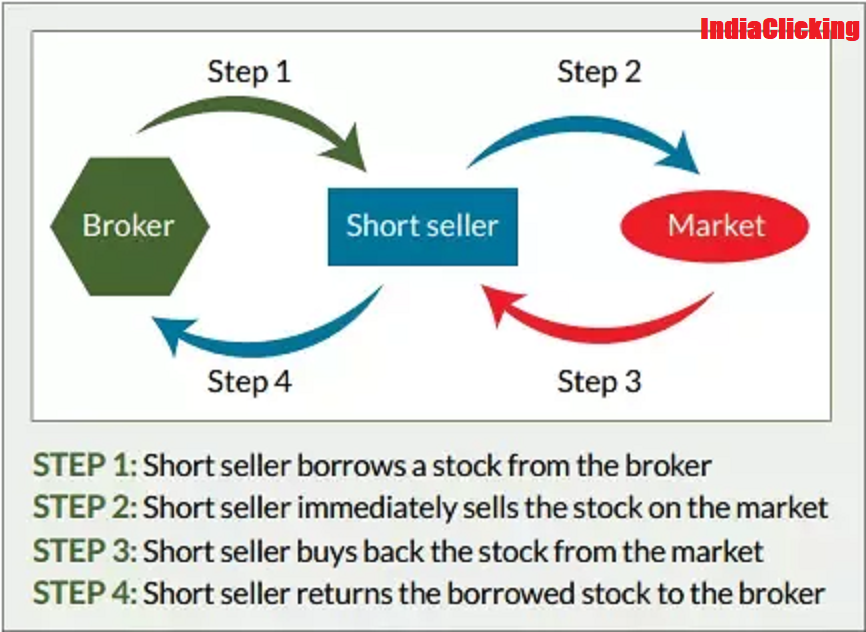

Also Read – What is short position in stock market ?

How is dividend pay-out calculated?

The dividend pay-out is the ratio of annual dividend per share with the net income of the company. For instance, if the dividend is 10 per share and you have 100 shares, you will receive a dividend of 1000. The dividend pay-out is received in 2 business days.

The dividend can be paid out monthly, quarterly, semi-annually, or annually. Sometimes, there is no set schedule for pay-outs, and if the company is making exceptional profits, it can also give out special one-time dividends. The pay-out may be in the form of cash or additional stocks.

The dividends may be used to repurchase shares in the open market. The dividend are also paid out in the form of the cheque which is usually credited to your bank account.

Income tax applicability on Dividends Pay-out

This is to remember that the interest earned from dividends is taxable.

Contact if not received the Dividends

If you are eligible for dividends and have not received it even after the dividend payment date, you will need to contact the companies’ registrar. You can find the details of the company registrar on the NSE website under ‘company information’ tab and BSE website under ‘corp information’ tab.

Leave a Comment